Contents:

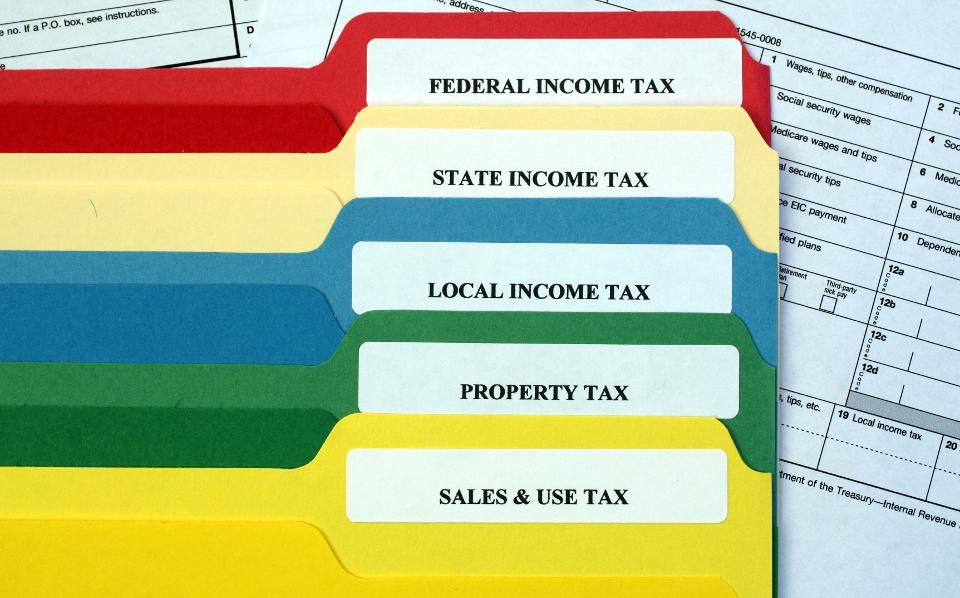

Generally speaking, your transactions fall into five account types—assets, liabilities, equity, revenue, and expenses. Individual line items are then broken down into subcategories called accounts. In our ice cream shop example, some accounts in your ledger might be “revenue-ice cream sales”, “expenses-ice cream ingredients”, etc.

The only fees you’ll experience with Wave will come from selecting optional add-ons – for example, payroll features – or accepting invoice payments. Wave charges a flat rate of 2.9% plus $0.60 per credit card transaction. The company also has additional payroll and bookkeeping services that business owners can access for a fee. The disadvantage of single-entry bookkeeping is that it doesn’t include accounts like accounts receivable, accounts payable, and inventory. That means you can’t generate a balance sheet or income statement, which are mandatory for public companies.

Intuit has an option called QuickBooks Live that adds bookkeeping support to Intuit QuickBooks Online Plus. You communicate with a dedicated bookkeeper through one-way video chat (they can’t see you) or email. This individual and their team work with you on customizing your setup and monitoring your transactions so they’re accurately entered and categorized for tax purposes. They reconcile your accounts and close your books at month’s end to prevent errors.

You do the same thing for the products and services you sell, so you can add them easily to transactions. Online accounting software can help you make smarter and better-informed plans for an uncertain future by organizing and automating your daily financial tasks. Every year, we test and rate the top web-based accounting services. Some are better for sole proprietors, freelancers, and companies with only one or two employees. Below you’ll find summaries of these applications, with an explanation of what makes them differ, along with what to look for when choosing the right software for your business.

Creating Reports to Improve the Business

With it, you can manage your payments in one central location, providing you with a clear picture of your finances. Payments, approvals, reconciliation and reporting are unified under one dashboard. The software includes smart approval workflows and secure electronic payments, which reduce errors and speed up the accounts payable process.

Neat lacks bill-paying functions, and there is no customer service phone number. The software is easy to install and can be used immediately without extra training. The website isn’t clear about pricing, so you need to contact a sales representative to determine the cost. QuickBooks Live Bookkeeper provides professional help and guidance for your accounting department. Start your free trial, then enjoy 2 months of Shopify for $1/month when you sign up for a monthly Basic or Starter plan.

This is an area of your statement of retained earnings that can easily get out of control if it’s not monitored. So, small business accounting software separates them into expense types. Then the software compares them to your income using totals and colorful charts. Patriot Software Accounting Premium is best for uncomplicated small businesses who probably won’t outgrow it.

ZipBooks lets you create and send beautiful invoices and estimates in seconds and accept credit cards with the click of a button. Our data-driven intelligence goes beyond the historical reports in other accounting software to automate, predict, and advise. After trying multiple accounting apps for 10 years, ZipBooks was finally the solution. My clients can pay online & accept quotes through a simple, interactive process.

How Much Does Accounting Software Cost?

For example, do you plan to use specific features such as purchase orders and inventory tracking? You can usually turn tools on or off, which can help you either simplify the user interface or maximize the functions available to you. Anaging your day-to-day finances is one of the most important tasks of any small business. Bookkeeping is the process of recording daily business transactions.

Best Accounting Software For Nonprofits 2023 – Forbes Advisor – Forbes

Best Accounting Software For Nonprofits 2023 – Forbes Advisor.

Posted: Tue, 11 Apr 2023 07:00:00 GMT [source]

This limited plan may be suitable for a micro-business with high-ticket transactions but only a few per month, such as a consulting or small service provider. Not only do the majority of small business accounting professionals use QuickBooks Online, but there are also endless online training resources and forums to get support when needed. All accounting features can be conveniently accessed on one main dashboard, making bookkeeping more fluid and efficient. Bookkeeping in a business firm is an important, but preliminary, function to the actual accounting function.

Patriot Software Accounting

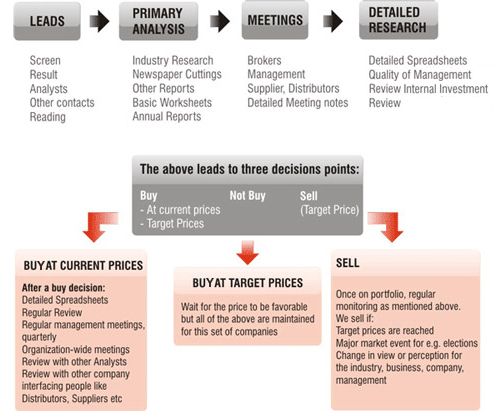

And the only way to know that for sure is to have accurate, up-to-date books. Also known as the profit and loss (P&L) statement, the income statement shows how profitable your business was over a certain period. This statement compares your business’s revenues to your business’s expenses. If your business had more revenues than it had expenses, it was profitable; if not, it took a loss. The balance sheet report provides your company’s net worth and lets you easily compare assets with liabilities.

It also gives you the ability to run financial reports, and it provides you with unlimited accountant connections and transactions. If you want to integrate popular business apps, you can do so at no extra charge. You need accounting software that tracks the money moving in and out of your business, with both accounts payable and accounts receivable features. Some software solutions don’t include both accounts payable and accounts receivable information. Also, accounting software should connect to your bank and credit card accounts and automatically download your transactions.

We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. These include NCH, Zoho Books, Kashoo, ZipBooks, Sunrise, GnuCash, TrulySmall Invoices and Wave Accounting.

Best Accounting Software For Mac (2023) – Forbes Advisor – Forbes

Best Accounting Software For Mac ( – Forbes Advisor.

Posted: Mon, 10 Apr 2023 07:00:00 GMT [source]

Nearly all new businesses are better off using accrual accounting, for two reasons. First, because the accrual method records transactions at the earliest possible moment, it allows businesses to track accounts payable and accounts receivable. That can provide a much more realistic view of the business’s profitability. Accounting services pay special attention to your company’s expenses—not bills that you enter and pay , but rather other purchases you make.

Best Accounting Software for Small Businesses

It also allows you to track fixed assets, which is an unusual tool in the category of small business accounting software. While the user experience is not exactly on the cutting edge, it’s still fairly easy to learn. Sage 50cloud Accounting is a massive small business accounting application that’s designed for desktop use. It’s the most comprehensive, customizable accounting program in this group of applications, though it does more than what many small businesses need, and it costs a bit more as well. The software offers built-in online connections that support some remote work, and it integrates with Microsoft 365 Business.

- This includes importing and categorizing transactions properly, reconciling these transactions and making sure they’re recorded according to your entry system and accounting method.

- The double-entry system better matches expenses related to producing a good or service and its resulting payment.

- Manage team permissions on reports, invoicing and billing, time tracking, or other parts of ZipBooks.

- For businesses looking for a payroll solution, QuickBooks Payroll fully integrates with QuickBooks Online.

- The accounting equation means that everything the business owns is balanced against claims against the business .

This is the same kind of accounting that individuals use when balancing their checkbooks. All online accounting services simplify the accounting process, but there will undoubtedly be times when you have questions. Some apps also provide context-sensitive help along the way and a searchable database of support articles. Once you have completed an invoice, for example, you have several options. You can save it as a draft or a final version and either print it or email it. You can create a PDF version of the invoice, copy it, record a payment on it, and set it up to recur on a regular schedule.

- For example, you don’t need a category for Shell Station Gas, but you probably also don’t want to just throw it under general expenses.

- All the accounting services reviewed here come with default settings that you may need to change.

- We believe everyone should be able to make financial decisions with confidence.

- After trying multiple platforms, ZipBooks proves to surpass all expectations.

- Previously, Holly wrote and edited content and developed digital media strategies as a public affairs officer for the U.S.

FreshBooks lets you easily craft invoices, accept payments through invoices, track expenses and send automatic reminders. An income statement is one of the four primary financial statements. It may go by other names, including the profit and loss statement or the statement of earnings. A spreadsheet may be all you need if you’re using a single-entry cash accounting method for your bookkeeping. Solopreneurs such as sole proprietors, single-member LLCs, and even those who hire contract help are the best candidates for this streamlined method.

Best Accounting Software for the Self-Employed Top 5 in 2023 – Tech.co

Best Accounting Software for the Self-Employed Top 5 in 2023.

Posted: Tue, 28 Feb 2023 08:00:00 GMT [source]

The single-entry method of accounting is considered incomplete as it does not recognize the nominal and real accounts but instead only maintains the business’ cash account. However, this won’t be an issue if you’re in a creative service-based business with few expenses related to producing your work . Service-based companies may also prefer the single-entry system because, without the complication of inventory, a more robust accounting system isn’t required. In this article, we’ll look at everything you need to know about these two modalities of bookkeeping, both single-entry systems and the double-entry method. We’ll also go over the difference between single-entry and double-entry and how to determine which one will be the most advantageous for your business’s financial position. If you’re a busy small business owner with a million things to do, it’s easy to let bookkeeping fall by the wayside.

Rachel recommends taking 10 minutes a week on Tuesdays to do your bookkeeping because it captures all of the transactions that happened over the weekend. Do you know your numbers as a business owner or are you afraid of them? Yes, I know bookkeeping is extremely dry and boring, but it is one of the foundational pieces that will really move the needle forward in your business. There are free options that have minimal features and specialized software that is more expensive. Most small businesses can find a lower-priced option that has the features they need.