Contents:

Ensure your accounting software automatically keeps separate ledgers as well as the general ledger. A cash disbursement can be recorded through the use of a journal entry that debits the proper A/P or expense account and credits cash. The inventory column records the discount of inventory purchases allowed by suppliers. The other accounts column includes all the cash payments besides credit purchases – such as equipment purchases, inventory purchases, and salary expenses. The payments for accounts payable are recorded in the accounts payable column.

East Liverpool BOE approves financial items, personnel News … – Morning Journal News

East Liverpool BOE approves financial items, personnel News ….

Posted: Tue, 28 Mar 2023 07:00:00 GMT [source]

Use the fields in this group box to specify the range of cash organizations to include in the posting. Only those checks that were assigned to the cash organizations specified in this group box will be included in the posting. This is due to a phenomenon called “cash float.” Floats are created by money in motion that has not arrived at its intended payee yet. Making an entry into the cash receipts journal and an equal and opposite entry into the sales journal.

You must also record cash receipts when you collect money from your customers. Record incoming cash payments in a separate cash receipts journal. Generally maintained by accounting software, these journals contain essential information such as the disbursement amount, check number, transaction type, payee, payer, and memo. But some businesses record other important details, such as discounts on bulk items purchased. Varying types of expenses may either be listed in different columns or they may receive distinct codes.

How do you do cash disbursement?

For small businesses, operating costs often need to be kept tight. If funds aren’t monitored closely, the company may quickly become insolvent. Disbursements represent the delivery of cash or cash equivalents from one public or dedicated fund to another. They are cash outflows and can be recorded in the cash disbursement journal.

Royalton approves city audit Morrison County Record … – ECM Publishers

Royalton approves city audit Morrison County Record ….

Posted: Sun, 09 Apr 2023 05:00:00 GMT [source]

The beginning accounts payable total, plus purchases on account during the month, minus payments on account during the month, should equal the ending accounts payable total. Compare this amount to the sum of the individual accounts payable ledgers. This will help you discover any errors you made in recording your payables. A reconciliation might also help you catch any errors on vendor bills. In your cash disbursements journal, mark each check that cleared the bank statement this month.

Why You Can Trust Finance Strategists

Your actual cash disbursements for insurance would be $600 in January, April, July and October. You need to make sure you have enough cash on hand during these months to make those payments. Different accounting forms show different types of payments, which might not give you a clear picture of your cash flow.

For example, if you’re creating an annual budget for your business, you might want to know your average monthly overhead. A typical cash payment journal is shown in the example below. The journal has a Date column, a Check Number column, a Payee column, and at least two credit columns, one for cash and one for purchase discounts. A cash disbursement journal is a method of recording all cash flows for your business.

On your bank reconciliation, list all checks from the cash disbursements journal that did not clear. Are there any checks that were outstanding last month that still have not cleared the bank? If so, be sure they are on your list of outstanding checks this month.

What is the Difference Between Disbursement vs. Reimbursement?

Our software can be customized to work with any system you have through a reliable connection. If necessary, other specific account columns can be added if they are used routinely. The debit columns will include at least an Accounts Payable column, a Purchases column, and the Other Accounts column. Enter, or use Lookup to select, the ending user ID for the range you want to include. Enter, or use Lookup to select, the starting user ID for the range you want to include.

- This term is never used for personal finance, only company payments.

- Enter, or use Lookup to select, the ending check for the range you want to include.

- Cash dividends are the one cash disbursement that doesn’t credit the cash account because you should have a “retained earnings” account on the other side of the ledger.

- The total value of the credit is $15,500, but Company B offered a discount of $500 to the company since it made the payment on time.

- For example, a payment made from a retirement account disburses funds to the account owner through a drawdown from the retirement funds.

- An entry of disbursement records the date, payee, purpose of payment, debit or credit amount, as well as the impact on a business’ cash balance.

You record income when you book the sale, not when you receive the payment. Keeping track of cash disbursements helps you better manage your cash flow. An entry to record the payment is included in the cash disbursement journal when the disbursement or cash payment is made. The cash disbursement journal is posted to the general ledger every month. Cash Receipts Journal.The cash receipts journal is the counterpart to the cash disbursement journal.

Accounts payable ledgers will help you control your expenditures and payables. If you maintain accurate payable ledgers, it will be easy for you to double check the bills you get from your suppliers. The petty cash drawer or box should be locked when not in use. Only one person should have access to the petty cash, so that one person is held accountable for it. Physically place the cash in a petty cash drawer or petty cash box. Simply plug in your daily amounts to see instantly whether you have a cash shortage or surplus at the end of the day.

Each account has a reference number shown in the posting reference column. This journal was widely utilized in manual accounting systems but is largely obsolete with the advent of computerized general ledger software such as Quickbooks. That said many small businesses still issue manual checks and the check register is in effect a single entry form of a cash disbursements journal. However most general ledger software can generate reports that look like the above cash disbursements journal. The cash disbursements journal is typically setup the same as other journal with columns for the transaction date, payee name, account debited, account credited, and the cash change.

investing activities includes receivable can be a little fun—after all, it’s all about raking in your hard-earned dough. Accounts payable (often called A/P), on the other hand, focuses on the unpaid bills of the business—that is, the money you owe your suppliers and other creditors. The sum of the amounts you owe to your suppliers is listed as a current liability on your balance sheet. This should have been apparent when you were preparing your lists of deposits in transit and outstanding checks. Physical control – Some assets, like cash, need physical monitoring to be protected from theft and misuse. Control activities may include the use of safes, locks, cash registers, biometric identification tools, or simple ID cards.

Part of cash management requires the proper internal controls for cash disbursements and cash receipts. Cash disbursements are monies paid out to individuals for the purchase of items that are needed and used by a company. This can be anything from purchasing inventory, raw materials, or even utilities. Cash receipts are money received from consumers for the sale of goods or services.

One example of this is adhering to the expense recognition principle. This is a generally accepted accounting principle that states you should recognize expenditures in the same period you generate revenue from them. If you buy t-shirts for $2,000 and sell them for $4,000, both expense and revenue should be recorded in the same period. The debit subtracts the amount from “rents payable,” which is a liability account. Because of this, it’s critical for businesses to keep track of these financial transactions. Write another check to “Petty Cash” for the total of the expenses.

- Read on to get a closer look at recording cash disbursements in your books.

- Both the cash amount has to be recorded under the cash credit account and the same amount has to be debited from a corresponding account.

- Sales Journal.The sales journal is the income counterpart to the purchase journal.

At the end of the month they are totaled and posted to the control account in the general ledger. Accountants refer to a “journal” as “the book of original entry.” Traditionally, when a transaction occurs, it is recorded first in the general journal. Then it’s copied, as appropriate, to a series of special purpose journals that keep track of related categories of transactions such as cash disbursements, sales, purchases, and payroll.

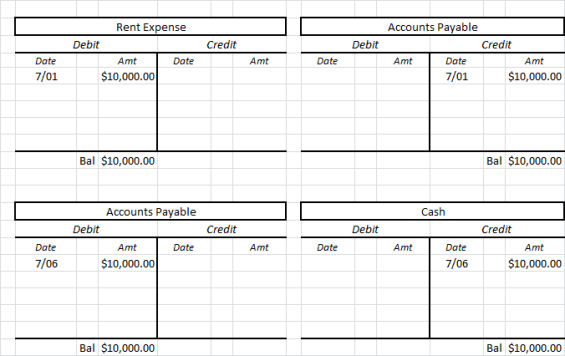

This is a very simplistic example but would show how https://1investing.in/s are recorded. Both the cash amount has to be recorded under the cash credit account and the same amount has to be debited from a corresponding account. Depending on the type, that account could be an inventory account or any other traditional balance sheet account. In this case, it has been put in an “other” category account. The information included in a cash disbursement journal is the disbursement amount, the check number, the transaction type, the payee, and any other pertinent information. Use this screen to post payments of vouchers to the general ledger.

With workflows optimized by technology and guided by deep domain expertise, we help organizations grow, manage, and protect their businesses and their client’s businesses. Conduct random, periodic checks on employees that handle cash to discourage theft. A limited number of people are authorized to handle cash and/or make cash transactions. For transactions where there is no invoice, the cash receipt may be the only proof of its occurrence. Employee payroll expenses like salaries and wages for management and laborers.